Adding an additional place of business in GST is mandatory for each business if they meet the eligibility criteria. Simply, visit the GST portal and follow the steps to upload supporting documents and other details for approval.

The Goods and Services Tax (GST) system has made business taxation in India quite simple. This process has enhanced uniformity and simplified business processes.

Businesses operating in one or more locations must ensure they have properly declared each place under GST to avoid penalties and legal consequences. Registering every operational site, like branches or warehouses, is important for compliance, transparency, and operational efficiency.

What is an Additional Place of Business under GST?

An Additional Place of Business (APOB) under GST refers to any location where a business conducts different business operations, excluding the registered principal place of business. Apart from the head office, certain businesses run operations through their branch offices, warehouses, retail showrooms, or godowns.

At the time of GST registration or when adding new business locations, it is essential for businesses to declare their additional places of business on the GST portal to remain compliant. Generally, a business can add up to 500 additional places of business in its GST registration. Just keep in mind that it is mandatory for each business to properly declare its locations and register separately under GST.

Let’s say your head office is in Delhi, but a few days back you opened a new showroom in Mumbai. In this case, you must add your Additional Place of Business under GST to avoid penalties. Further, proper registration can help claim certain benefits.

Why Add an Additional Place of Business?

Business expansion to multiple locations or setting up a new branch office is often considered a sign of growth, but there are also certain responsibilities that one must not miss. Whether you are opening a new branch or renting a warehouse, it is important to list these locations in your GST registration to stay compliant under GST law.

Failing to do this can result in penalties/interest, loss of Input Tax Credit (ITC), etc. In some cases, authorities can even seize your goods, or you may face legal consequences. However, if you opened a showroom in Mumbai (apart from the main location in Delhi) and added your APOB under GST, it can benefit you in several ways, such as:

- Legal Compliance: You can save yourself from paying fines or facing legal issues.

- Input Tax Credit (ITC): Taxpayers can claim Input Tax Credit on business expenses or purchases made from that additional location. For example, you can claim GST on rent or utilities paid for the Mumbai showroom (only if added your APOB)

- Better Supply Chain Management: Registered operational business locations allow for smoother logistics and distribution. Adding APOB helps in smooth goods movement. Also, it can be used during audits or transit checks.

- Operational flexibility: APOB registrations ensure taxpayers don’t face roadblocks during expansion. For example, when raising an invoice from the new showroom.

Prerequisites and Key Considerations

Before you proceed with the necessary documents, keep these in mind:

- Threshold Limit and Eligibility: It is important to make sure that the turnover crosses the GST registration threshold. As per a recent update, businesses with annual sales of Rs. 40 lakhs (for goods) and Rs. 20 lakhs (for services) or more must apply for GST registration.

- State-Wise Registration: If you have opened a new showroom in the same state (for example, Delhi), you must add the additional place under your Delhi GSTIN. However, if you have opened a new showroom in any other state than PPOB (for example, Mumbai, i.e., outside PPOB Delhi), you must register your Mumbai Showroom as a separate GST registration.

- Planning and research before expansion: Choose strategic locations and prepare yourself with the essential documents in advance to avoid delays and other issues.

What are the documents required for registering an additional place of business?

- Proof of address: Ownership documents or a sale deed can be submitted for address verification. In case the premises are available to you on rent, you can submit a rent/lease agreement.

- No Objection Certificate (NOC): In case of rented properties, a signed NOC or consent letter from property owners is considered valid proof.

- Authorized Signatory & Digital Tools: The signatory’s registered email address or mobile number if using electronic verification code (EVC) or DSC for signing.

- GST registration certificate: The GST Registration Certificate of your primary place is needed.

- Bank Details: A cancelled cheque or a Bank Account statement might be required.

Step-by-Step Process to Add Additional Place of Business on GST Portal

Step 1: Visit the official GST portal and log in to your account.

Step 2: From the menu section, go to Services> Registration -> Amendment of Registration (Core Fields)

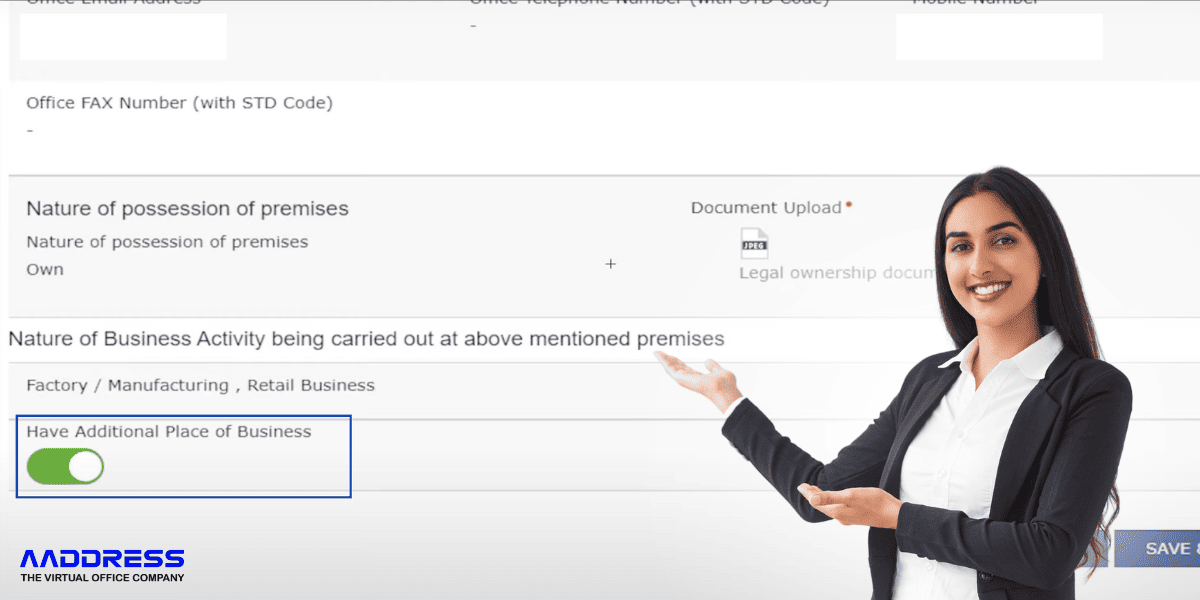

Step 3: Under the “Additional Places of Business” Section, you might track no data if no additional places were added before. However, if they were, you can view the count at the top before places are listed. If no APOB was listed, go to the PPOB tab and enable the APOB setting to add a new place.

Step 4: Once enabled, you can view the “Add New” button below. Click it to enter the New Business Location Details (Address, contact information, reason for amendment, date, and nature of possession). Double-check the information with your proof documents to avoid errors.

Step 5: Attach your Supporting Documents in this step as listed above for further verification.

Step 6: Proceed with the “Verification” tab and make sure to tick the declaration checkbox. Select the Authorized Signatory’s name, place of signing, and mode for submission, i.e., DSC, EVC, etc.

Step 7: After submission, you will receive a 15-digit Application Reference Number (ARN) Confirmation and application status on your screen. Save the ARN number for the amendment request.

Step 8: Approval by tax officer: Once checked and approved by the tax officer, an approval order Form GST REG-15 along with the GST Registration Certificate is available for download.

Post-Registration Compliance

Once your new place is registered, make sure to create separate records for each location. Also, do not miss filing GST returns covering all the details of transactions at the additional places listed. It is also important to keep your GST registration up to date with any further changes.

Common Challenges and Solutions

- Document discrepancies – Taxpayers often submit incorrect or incomplete documents. Hence, ensure each document is up to date and accurate. You can also take professional help to avoid such errors.

- Navigating state-specific regulations: Confusion may happen as some people have no idea what steps they need to follow for other state submissions. Hence, reach out to a GST practitioner or local expert for proper assistance.

- Timely approval and compliance: Physical verification delays can happen due to unclear address signage. Hence, ensure you have clear address signage and availability.

Conclusion

Adding an additional place of business under GST is not a simple process. Taxpayers need to have the right documents in hand and prepare before making submissions. Simple steps can help you achieve your goals, but incorrect information submission can result in delays. Hence, consult a GST professional for guidance and go through the challenges and solutions for better results.

FAQs

- When is GST registration needed for an additional place?

If a business expands its operations by setting a new office in a different location or carrying out business activities in a place other than its principal place. For example, a rented warehouse, godown, or new service outlet.

- What if the business does not have any additional place yet?

No problem, just make sure your principal place of business is properly added to the documents.