Starting a water bottle business in India can be a smart and rewarding move.

With a growing population, increasing awareness about health, and rising demand for safe drinking water, the packaged water business in India is booming.

But while the opportunity is huge, so is the competition.

This guide will help you understand the steps, costs, challenges, and solutions to build a successful water bottle brand—whether you want to set up a plant or take up distribution of big names like Bisleri.

- Why the Water Bottle Business is a Growing Opportunity – India’s packaged water industry is expected to grow at a CAGR of 12–15% in the next 5 years. Source: DiMarket

- Increasing urbanization, travel, and health awareness are pushing demand.

- People prefer the best water brands in India like Bisleri, Kinley, Aquafina—but new brands are emerging with eco-friendly, alkaline, or premium water.

Did you know? Even Bisleri started small in India in the 1960s before becoming a household name!

Step-by-Step Guide to Starting Your Water Bottle Business

1) Decide Your Model

There are 3 main ways to enter the water bottle business in India:

| Model | What it Means | Example |

|---|---|---|

| Own Mineral Water Plant | Set up your factory, produce and sell your brand | Himalayan, Clear |

| Franchise / Distribution | Distribute for an established brand | Bisleri distributor |

| Bulk Distribution / Repackaging | Buy in bulk, rebrand or supply | Local suppliers |

If you’re thinking: “How to start Bisleri water business?” — consider applying for their distributorship program.

2) Understand Plant Setup Cost

Setting up a plant can cost anywhere between ₹15 lakh to ₹75 lakh depending on size, technology, and capacity.

| Expense | Estimated Cost (₹) |

|---|---|

| Land & Building | 5–15 lakh |

| Machinery | 8–25 lakh |

| Licenses & Certifications | 1–2 lakh |

| Packaging Materials | 50,000+ (initial) |

| Staff & Utilities | 30,000–1 lakh/month |

Tip: Start small, and plan to scale once you break even.

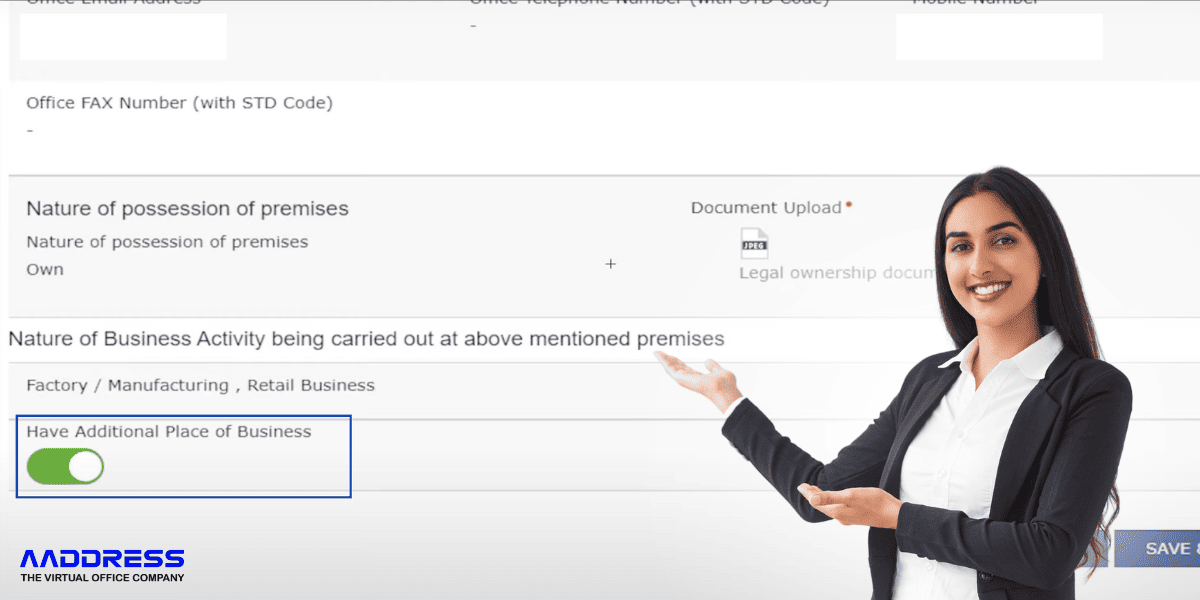

3) Get the Right Licenses

In the packaged water business in India, compliance is critical. You’ll need:

- BIS certification

- FSSAI license

- GST registration

- Pollution control NOC

- ISI mark for packaged drinking water

Real-world challenge: Many small brands have faced closure due to missing BIS or FSSAI approval. Avoid shortcuts—ensure all approvals are in place.

4)Focus on Quality and Differentiation

The market is flooded with mineral water business brands. What will make yours stand out?

- Offer alkaline or pH-balanced water

- Use eco-friendly packaging — glass bottles or biodegradable PET

- Build a trustworthy brand with clear labeling, consistent taste, and strong quality checks

Example: Clear Premium Water gained attention by offering water in glass bottles to cater to premium customers.

5) Plan Distribution Smartly

Your success will depend on your distribution model. The water distribution business works best when you target:

- Hotels, restaurants, cafes (HoReCa sector)

- Corporate offices and co-working spaces

- Events, weddings, sports grounds

- Retail shops, kirana stores

- Online platforms (Amazon, Flipkart)

Solution: New brands often struggle with shelf space in large retail chains. Instead, focus on local tie-ups and direct delivery models.

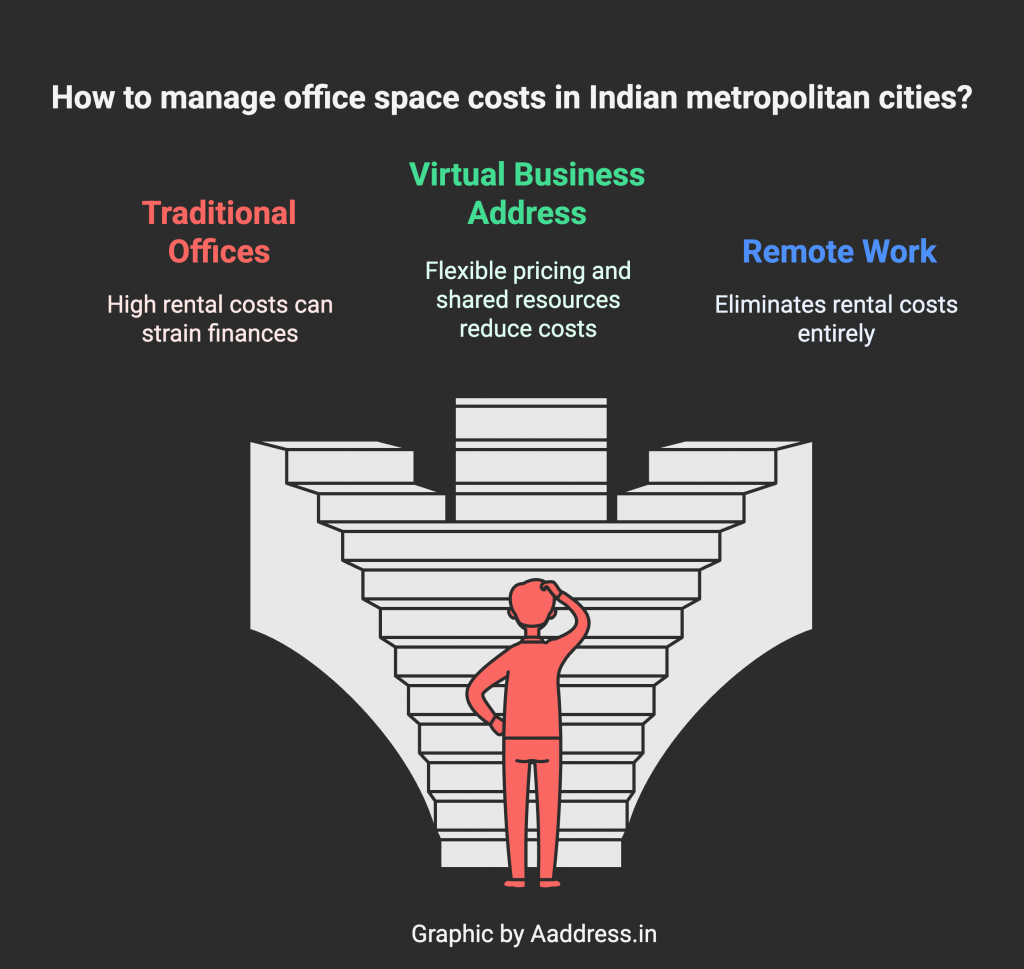

How a Virtual Office Can Support Your Water Bottle Business

Many people think a water bottle business in India needs expensive office rent. Not true! A virtual office address can help you:

- Get a legal address for GST and company registration

- Look professional to corporate clients and distributors

- Save ₹15,000–₹50,000/month on rent

Expand easily into multiple cities without needing physical space. Get a free consultation call with us.

Example: A Delhi-based packaged water startup saved over ₹5 lakh in its first year by using a virtual office address for GST and correspondence.

Common Questions Answered

Q: What’s the mineral water plant setup cost for a small plant?

It usually comes between ₹15–20 lakh for basic setup, ₹50 lakh+ for mid-sized plant.

It can cost you even lower depending on factors like the location (rural or semi-urban areas often have cheaper land and utility costs), the scale of production, type of machinery (manual or semi-automatic instead of fully automatic), and whether you start with a rented facility rather than constructing a new building.

By sourcing local equipment and keeping packaging simple, many entrepreneurs have managed to set up a small plant for as low as ₹10–12 lakh.

Q: How to start a Bisleri water business as a distributor?

Apply on Bisleri’s website, meet minimum area and investment criteria (usually ₹2–5 lakh initial stock).

Q: Which is the best water brand in India to take franchise for?

Bisleri, Aquafina, Kinley are trusted. But premium niche brands like Himalayan or Clear are good for high-end markets.

Q: Can I sell online?

Its brilliant idea to sell online.You can do it by e-commerce platforms such as Amazon & Flipkart + local delivery apps (Instamart, Blinkit, Zepto etc)

Q: What are the key challenges in this business?

The common and key challenges are compliance delays, huge transport cost (water is bulky!), labour cost, local competition, low retailer margin.

What can you do: You can focus on unique offerings such as eco-friendly bottles, subscription models for residentials and commercial people.

Conclusion

The packaged water industry in India offers solid growth opportunities—but success comes to those who plan well. Whether you choose to start your own plant or become a distributor, remember:

- Quality and compliance win trust

- Smart distribution beats heavy advertising in the early stage

- Virtual offices help you save money and expand fast