Highlights:

-

- To promote entrepreneurship, the Delhi government has prepared a Startup Policy. A provision of Rs 50 crore has been made in the 2022-23 Budget for the implementation of the Policy.

- Revenue expenditure in 2022-23 is estimated to be Rs 53,687 crore, which is an increase of 6% over the revised estimate of 2021-22 (Rs 50,862 crore).

- Delhi’s economy is characterized by a strong service sector, with the tertiary sector being the largest contributor to the Gross State Domestic Product (GSDP).

- Delhi has emerged as a start-up hub and the government has taken initiatives to promote entrepreneurship and create a conducive environment for knowledge-based economic activities.

- The region has also witnessed a significant rise in startup funding, with the startups based in Delhi-NCR raising $5.2 billion in 2022.

Overview

Delhi is fast, crowded, opportunity-rich, and brutally competitive—in a good way. If your business makes life easier (time saved, better service, better taste, cleaner convenience, more trust), Delhi rewards you quickly. This guide shares practical business ideas in Delhi that fit different budgets—from home-based starts to scalable models like cloud kitchens, e-commerce, and corporate services—plus a comparison table and a simple checklist of documents you’ll need.

Table: Business ideas in Delhi (comparison chart)

How to read this table: “Investment” is a practical label (Low / Medium / High), not a strict rule. Actual cost depends on location, equipment, and how “premium” you go.

| Business idea | Investment | Best for | Key documents/licences (common cases) | Why it works in Delhi | Fast first step |

|---|---|---|---|---|---|

| Food delivery service with a twist | Medium | Food operators, chefs | Often FSSAI + basic registrations | High demand + repeat orders | Pick 1 niche menu + 1 delivery radius |

| Personalized event planning | Low–Medium | Organizers, creatives | Business registration (if scaling) | Weddings + corporate events are constant | Build 3 packages + vendor list |

| Tech-enabled home services | Medium | Operators, tech-savvy | Business registration | Convenience market is huge | Start with 1 service category |

| Eco-friendly products store | Low–Medium | Retailers, curators | Business registration (if scaling) | Sustainability trend + gifting | Start online + weekend pop-ups |

| Health & wellness tourism | Medium–High | Wellness professionals | Depends on services offered | Delhi attracts wellness seekers | Create 2 curated packages |

| E-learning platform (skills) | Low–Medium | Trainers, teachers | None to start (often) | Skills demand keeps rising | Launch cohort course on 1 skill |

| Urban farming & organic produce | Medium | Growers, communities | Depends on selling model | Fresh produce demand + premium buyers | Start with microgreens/rooftop pilot |

| Cultural experiences for tourists | Low | Guides, storytellers | Depends on structure | Delhi’s heritage is a product | Design 1 heritage walk route |

| Cloud kitchen / subscription tiffin | Medium | Cooks, operators | Often FSSAI | Predictable repeat demand | Run 30-day subscription trial |

| Real estate brokerage / rental management | Low | Networkers, negotiators | Local compliance as needed | Rentals + commercial churn | Pick 1 micro-market + 1 category |

| Boutique clothing / ethnic wear | Medium | Designers, merchandisers | GST may apply (case-based) | Fashion + weddings fuel demand | Start with 12–20 SKUs + reels |

| Health-focused café / juice bar | Medium–High | Food entrepreneurs | Often FSSAI | Fitness and “clean eating” crowd | Test with 1 kiosk / cloud setup |

| E-commerce store (products) | Low–Medium | Sellers, marketers | Business registration (if scaling) | D2C has low entry barriers | Choose 1 category + 1 platform |

| Digital marketing agency | Medium | Marketers | Business registration | Every local business wants leads | Offer 1 core service + 2 upsells |

| Consulting services | Low | Experienced professionals | Business registration (if scaling) | B2B spending is strong | Package your expertise into offers |

| Freelancing | Low | Writers, designers, devs | None | Delhi clients + global clients | Make a portfolio + 10 pitches/week |

| Tuition / coaching | Low | Teachers, toppers | None | Education spending is reliable | Pick 1 class/subject niche |

| Baking / cooking (home-based) | Low–Medium | Home chefs | Often FSSAI | Gifting + small events | Start with 3 signature items |

| Handmade crafts & products | Low–Medium | Artisans | None | Gifts + marketplaces | Launch with 20 listings |

| Fitness training | Low–Medium | Trainers | Certification | Demand for personal training | Offer 14-day starter plan |

| Beauty & wellness services | Low–Medium | Beauticians | Certification | High repeat frequency | Start home visits + referrals |

| Solar installation / maintenance | Medium | Technicians | Case-based | Rising energy awareness | Partner with installer + lead gen |

| EV two-wheeler charging / service tie-up | Medium | Operators | Case-based | EV adoption + daily commute | Tie up with 1 society/market |

| Last-mile logistics / delivery partners | Low | Hustlers, operators | Case-based | Delhi runs on delivery | Start with 1 route + 1 client type |

| Corporate services (compliance/back-office) | Low–Medium | Admin/legal/ops | Case-based | Businesses need paperwork done | Offer GST/ROC/payroll bundles |

| Pet grooming / pet supplies | Low–Medium | Pet lovers | Case-based | Pet spending is rising | Start with grooming + add-ons |

| Thrift / resale (online + pop-ups) | Low | Curators | None to start | Value-driven buyers | Source 50 items + weekend pop-up |

| Used electronics refurb/resale | Medium | Technicians | Case-based | Constant demand + margins | Start with 1 category (phones/laptops) |

| Micro-warehouse / inventory storage | Medium | Ops-focused | Business registration | Supports e-commerce sellers | Rent small storage + 3 clients |

| Home-based event planning (starter) | Low | Beginners | Business registration (if scaling) | Easy to start from home | Plan 1 small event at discount |

Introduction:

Are you ready to embark on a journey through the entrepreneurial wonders that Delhi has to offer?

As India’s vibrant capital, Delhi isn’t just rich in history but also teeming with opportunities for savvy business minds like yours who want to start their own business.

In this blog, we’re going to uncover some exciting and promising profitable business ideas tailor-made for Delhi’s dynamic market.

Ready to explore the entrepreneurial landscape of Delhi? Let’s dive straight into the bustling world of profitable business ideas in Delhi!

Which business is best to start in Delhi (in 2026)?

The “best” business depends on market gaps, your skills, time you can give daily, resources, and budget. Instead of chasing what looks trendy, aim for what you can execute consistently.

Here are strong business opportunities you can start in Delhi—updated with 2026 demand patterns—while keeping the original ideas intact and expanding them with practical detail.

1) Food delivery service with a twist

Delhi’s food delivery market is big, but the winners aren’t always the biggest kitchens—they’re the most distinct. A “twist” can be:

- a tight niche (healthy bowls, millet-based snacks, regional thalis)

- a strict promise (no refined sugar, macro-counted meals)

- a targeted audience (gym crowd, office lunches, night-shift meals)

If you want the most scalable version of this idea, build it like a cloud kitchen: simple menu, consistent taste, fast prep, tight delivery radius, repeat customers.

Source Credit: https://www.youtube.com/@AMAZEGYAN

2) Personalized event planning

Delhi is known for weddings, birthdays, corporate launches, and social events. The opportunity is in personalization—themes, experiences, and stress-free coordination.

What makes you stand out:

- clear packages (starter / premium / luxury)

- vendor network (decor, catering, photography, makeup, anchors)

- timeline discipline (Delhi clients value “no drama” execution)

Source Credit: https://www.youtube.com/@randomfireworks

3) Tech-enabled home services

In Delhi, convenience sells. A platform that helps people book home cleaning, repairs, laundry, or salon-at-home can work well if you focus on:

- reliable professionals

- transparent pricing

- fast response times

- quality checks

Even without building a full app, you can start lean with WhatsApp booking + Google Form + a clear rate card, then scale later.

(Keep your existing “Click here to know more about how to start tech-enabled home services” link in this section.)

4) Eco-friendly products store

Eco-friendly isn’t “slow” anymore—people want safer, smarter alternatives:

- biodegradable cleaning supplies

- refillable personal care

- sustainable gifting

- organic clothing

Start small: online store + weekend pop-ups in busy markets. Partner with local artisans and smaller brands to keep your assortment unique.

Source Credit: https://www.youtube.com/@AnujRamatri

5) Health and wellness tourism

Delhi brings in visitors for work, healthcare, and travel. A wellness business can package:

- yoga + meditation sessions

- ayurvedic experiences

- weekend retreats

- guided wellness routines for travelers

If you don’t own a resort or space, partner with ones that do. Your job becomes curation + marketing + experience design.

(Keep your existing “Click here to know more about how to start your health and wellness tourism business” link in this section.)

6) E-learning platform for skill development

Skills sell well in Delhi—especially those linked to jobs or side income:

- digital marketing

- coding basics

- design tools

- spoken English

- interview preparation

- photography/video editing

Start with one course, one outcome, one cohort. People pay more when the result is clear.

(Keep your existing e-learning “Click here to know more…” link in this section.)

7) Urban farming and organic produce

Even in a dense city, urban farming can work through:

- rooftop gardens

- hydroponics

- microgreens

- community farms

- subscription produce boxes

Instead of trying to supply “everything,” win a narrow lane: microgreens for cafés, organic veggies for a small set of households, or herbs for premium customers.

8) Cultural experiences for tourists

Delhi is a cultural goldmine—heritage walks, food trails, craft workshops, and local storytelling experiences can become a real business.

Ways to make it premium:

- small group experiences (better margins)

- photo-friendly routes

- niche themes (Mughal architecture, street food history, spice tours, etc.)

- partnerships with hotels and travel agents

Bonus: More business ideas in Delhi that are working well in 2026

(These are added to enhance depth and match current search intent—without removing anything from your existing article.)

9) Cloud kitchen / subscription tiffin model

If you want predictable revenue, subscription tiffins work well in Delhi. Offices, students, and working professionals often prefer a consistent meal plan over random ordering.

10) Real estate brokerage + rental management

Even a lean brokerage model can work if you specialize: one micro-market (Dwarka / Rohini / Saket / etc.) and one segment (rentals, PGs, commercial shops, office leasing).

11) Boutique clothing (offline + Instagram + D2C)

Delhi’s fashion market runs on weddings, festivals, and everyday style. You can start with curated drops, then scale through reels + repeat buyers.

12) Health-focused café / salad bar / juice concept

People want convenient “clean” options. If you manage taste + consistency, you can build strong repeat traffic.

13) Solar installation, servicing, and energy audits

Solar adoption and energy-saving upgrades are rising. You can start as a lead-gen + partner model, then build technical capacity.

14) EV support services (charging tie-ups + two-wheeler service)

EV two-wheelers are increasing. Charging tie-ups with societies, markets, and parking operators can create steady footfall, especially when combined with service/repair.

15) Pet grooming + pet essentials

Delhi’s pet economy is real. Grooming, boarding tie-ups, and premium pet supplies can be combined into a strong local brand.

16) Thrift/resale store (online + pop-ups)

Value-conscious buyers love curated thrift. Pop-ups help build trust; Instagram helps scale.

17) Used electronics refurb/resale

If you can test and refurb reliably, margins can be strong. Start with one category and build reputation on quality checks.

18) Corporate services (compliance + back-office)

This fits naturally with your brand. Businesses need help with registrations, compliance, mail handling, and credibility.

If someone doesn’t have a physical office space/address, they can also get their business registered with a virtual office address in Delhi (keep your existing internal link here). Also keep your internal link to your guide on what is virtual office, and your step-by-step guide on how to register your company.

Home-based business in Delhi

Starting a home-based business in Delhi can be convenient and cost-effective—especially for beginners and students looking for business blaster ideas. Here are home-based options that work well:

Home-based ideas (quick table)

| Business Idea | Investment | Potential | Documents Required | Description |

|---|---|---|---|---|

| Freelancing | Low | High | None | Freelancing in areas such as writing, graphic design, programming, or marketing requires minimal investment and has high potential due to the demand for digital services |

| Tuition or Coaching | Low | High | None | Providing tuition or coaching services can be started with low investment and has high potential due to the demand for educational support |

| Baking or Cooking | Low to Medium | High | FSSAI License | Starting a home-based baking or cooking business requires a low to medium investment, with the need for an FSSAI (Food Safety and Standards Authority of India) license to ensure food safety and quality |

| Handmade Crafts and Products | Low to Medium | High | None | Creating and selling handmade crafts and products can be started with a low to medium investment and has high potential, especially with the rise of e-commerce platforms |

| Fitness Training | Low to Medium | High | Certification | Offering fitness training services from home requires a low to medium investment and certification to ensure professional standards and attract clients |

| Beauty and Wellness Services | Low to Medium | High | Certification | Providing beauty and wellness services, such as skincare or massage, requires a low to medium investment and certification to ensure quality and safety standards |

| Digital Marketing Agency | Medium to High | High | Business Registration | Starting a digital marketing agency from home requires a medium to high investment and business registration to operate legally and attract clients |

| Event Planning | Low to Medium | High | Business Registration | Offering event planning services from home requires a low to medium investment and business registration to ensure professional and legal operations |

| E-commerce Store | Low to Medium | High | Business Registration | Starting an e-commerce store from home requires a low to medium investment and business registration to operate legally and reach customers online |

| Consulting Services | Low to Medium | High | Business Registration | Providing consulting services in areas such as finance, HR, or marketing requires a low to medium investment and business registration to ensure professional and legal operations |

Freelancing

Offer your skills as a freelancer in writing, graphic design, web development, digital marketing, consulting, or virtual assistance. Platforms like Upwork, Freelancer, and Fiverr can help you find clients—but a simple portfolio and consistent pitching matters more than platform-hopping.

Tuition or Coaching

If you’re strong in a subject or skill, start coaching from home. Options include academic tuition, music lessons, dance, languages, or exam preparation. A clear result (marks improved, concept clarity, mock tests) drives referrals.

Baking or Cooking

If you love baking or cooking, start with a small menu you can repeat perfectly. You can specialize in cakes, cookies, snacks, or full-course meals for small parties and events.

Handmade Crafts and Products

If you can make crafts, jewelry, home décor, or personalized gifts, sell through marketplaces or your own storefront. Product photos, packaging, and consistency create trust.

Fitness Training

If you’re certified (or already trained), offer personal training, yoga, aerobics, or online classes. Delhi customers value structured plans and visible progress.

Beauty and Wellness Services

Home salon services like makeup, hair, manicure/pedicure, or massage can be started with a small kit and strong hygiene standards.

Digital Marketing Agency

Offer social media management, SEO, PPC, content creation, and email marketing to local businesses. Start with one core service, then upsell reporting, creatives, and lead generation.

Event Planning

If organizing is your strength, plan birthdays, weddings, or corporate events. Create packages, timelines, and a vendor list so you look professional from day one.

E-commerce Store

Sell clothing, accessories, handmade items, or specialty goods. Start lean, validate demand, then scale inventory and ads.

Consulting Services

If you have expertise in finance, HR, operations, marketing, or career guidance, you can consult from home. Package your help into fixed offerings instead of “pay per hour” only.

Before starting any home-based business, check local regulations and zoning laws for operating from home in Delhi. Create a dedicated workspace and invest in basic tools so you can deliver reliably.

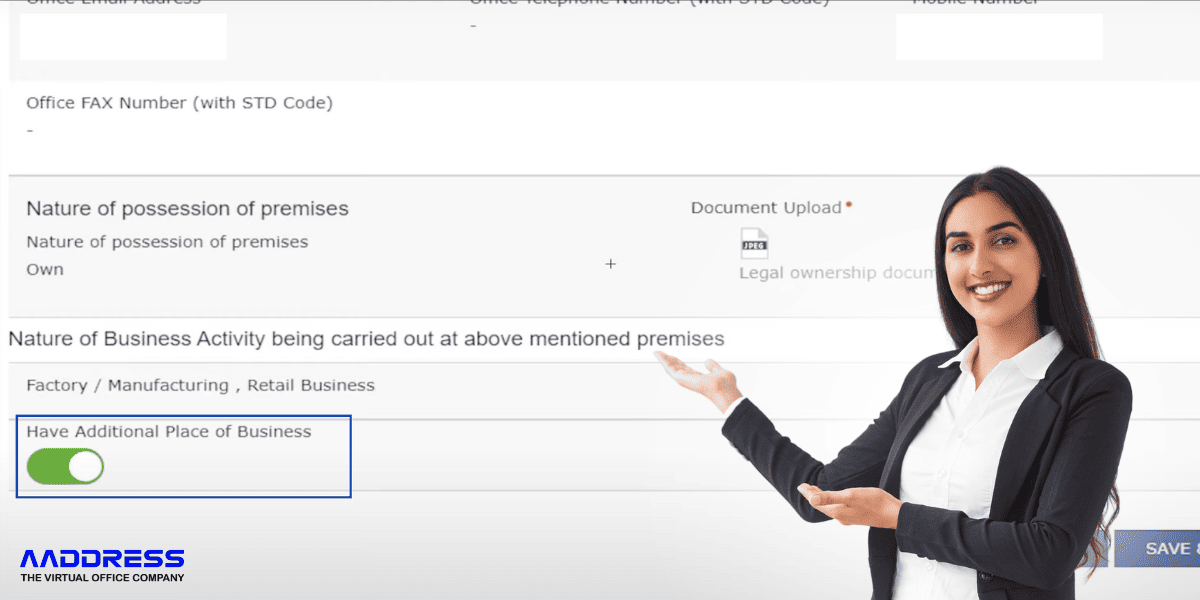

Basic Documents Required for Starting your Own Business in Delhi

- ID’s and Proof of Address for all directors and shareholder: PAN Card, Aadhar Card, Passport, Driving License, or Voting ID.

- Address Proof for Place of Business: rental agreement, property registration certification.

- If you don’t have a physical office space/address, you can also get your business registered with a virtual office address in Delhi (keep your existing internal link).

- Are you new to the concept of virtual office? Keep your existing internal link to your guide on what is virtual office.

- NOC from the owner of the place of business if the place is rented.

- Passport size photograph of all the Directors as well as the shareholders.

- If you have not registered your business yet, keep your existing internal link to how to register your company.

Conclusion

Delhi’s size and speed create two realities: there’s competition, and there’s endless demand. The best approach is to pick a business idea that matches your skills, start lean, validate demand locally, and scale only after the basics are stable.

Whether you’re passionate about food, wellness, technology, sustainability, or services, there’s a profitable niche waiting in Delhi. Focus on consistent delivery, clear positioning, and trust—Delhi customers reward reliability.

So roll up your sleeves, stay sharp, and start building.

DISCLAIMER: All the videos and photos used in the above blog are owned by their respective owners.

FAQs: Business ideas in Delhi

1) Which business is best to start in Delhi with low investment?

Freelancing, tuition/coaching, home baking, beauty services, and niche reselling are strong low-cost starts—especially if you already have the skill.

2) What are the most profitable business ideas in Delhi in 2026?

Food models (cloud kitchens/subscriptions), last-mile services, e-commerce, event planning, and corporate services tend to perform well when executed consistently.

3) Do I need a physical office address to register a business?

Not always. Many businesses use a proper business address setup depending on their registration/compliance needs. (Keep your virtual office internal link here.)

4) How do I choose the right idea quickly?

Pick one idea that matches your skill, test demand in a small area, collect feedback, and improve weekly. Delhi rewards speed—but only when quality stays consistent.

5) What’s the fastest way to get first customers?

Local WhatsApp groups, referrals, small trial offers, clear pricing, and a simple Google presence can get you traction faster than overbuilding a brand early.