New Delhi, India, [22 Oct] – The name of the company that helped thousands of Indian business owners create their brand is now different. Address.co is the new name for Aaddress.in. This is a new step in their journey to make virtual office addresses easy, cheap, and available all over India.

Aaddress.in has quietly helped more than 20,000 businesses over the years, including startups, freelancers, MSMEs, and online sellers, by giving them a verified business address without the need to rent physical space. The company is changing its name to Address.co as part of its plan to update its brand and better serve India’s growing number of digital-first entrepreneurs.

Ankur Goel, the founder of Address.co, says that the new name fits with the company’s plans for the future.

“When we first started, we wanted to help small business owners who couldn’t afford to set up expensive offices. It started out as a simple idea, but it has grown into a platform that people all over the country can use. Address.co is more than just a shorter name; it’s a step towards meeting the needs of our customers.”

Why Address.co?

Moving to Address.co is more than just getting a new web address. It shows how dedicated the brand is to giving its users a better, tech-based experience. The company is still adding to its network of virtual offices in all of India’s major cities, such as Delhi, Mumbai, Bengaluru, Hyderabad, Pune, and Chennai.

The new platform still offers services like:

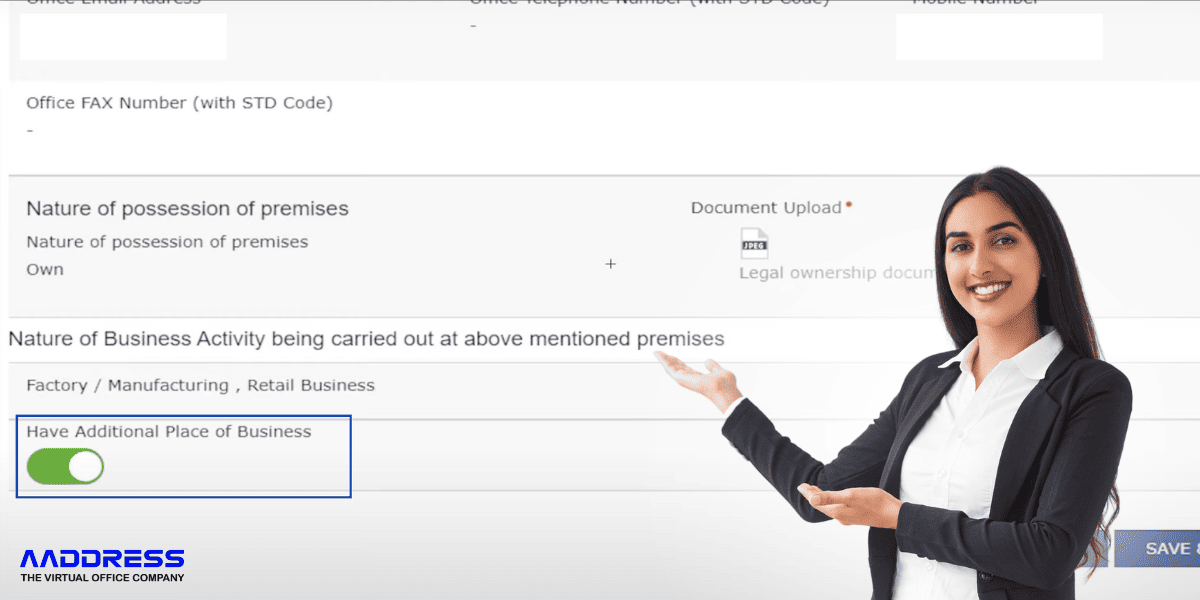

- For GST, MCA, and business registration, verified virtual office addresses are available.

- Taking calls and handling packages for firms that work from home.

- High-end commercial sites all around India.

- Plans that are easy on the wallet cost at least ₹999* a month.

Address.co is one of the most reliable virtual office providers in India since they check every address on their site to make sure it is legal.

What This Means for Customers Right Now

People who already use Aaddress.in won’t have any problems with their services. All current contracts, registrations, and mail handling will continue as usual. The only thing that has changed is the new website, www.address.co. Now, it’s the company’s principal web home.

Goel said,

“Our customers’ trust has always been what has helped us grow. We want to use that same trust to make things even better with Address.co: faster onboarding, smarter tools, and better support for every entrepreneur who chooses us.”

Looking Ahead

As India gets closer to digital entrepreneurship, the requirement for legal business addresses is expanding swiftly. Address.co intends to keep ahead of the competition by integrating AI-powered verification tools, automated document processing, and smarter location discovery services to let users receive their virtual office address in only a few clicks.

About Address.co

Address.co (formerly Aaddress.in) is India’s most popular virtual office address provider. It helps businesses create professional identities for GST, MCA, and other government registrations. The company has helped more than 20,000 businesses in India since it started in 2019. Startups, consultants, and online merchants who want to look good without spending a lot of money on office space appreciate it since it has confirmed locations, transparent rates, and is straightforward to set up.

Address.co wants to sign up 300,000 new clients by 2030 since more and more startups, entrepreneurs, established businesses, small and medium-sized businesses (SMEs), and micro and small businesses (MSMEs) in India want Virtual Offices.